Distributions

As per standard Oracle functionality, minimum transaction header and line data must be entered before Distribution data can be entered.

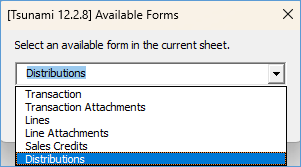

To enter ‘Distribution data, position your cursor in the ‘Sales Credits’ section of the worksheet, on the row you wish to enter the data. Then double-click in one of the cells or alternatively click on the ‘Forms’ button and select ‘Sales Credits’.

The Distributions section of the worksheet is split into two subsections:

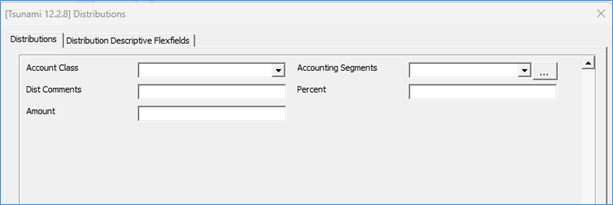

a) Distributions

The ‘Distribution’ section allows you to distribute transaction amounts to accounting segments and account classes.

Enter Accounting Segments to be assigned. Start by selecting ‘New’ and continue adding ‘New’ Accounting Segments against the transaction line as required. On closing the form these new records will be added to the distribution section for the transaction line in the Wizard and any other existing transaction lines will be moved down to accommodate these distributions.

Revenue Account Allocation Batch Source settings are ignored. The API will send what is entered in the Wizard and derive the other figure i.e. If only Percent is entered, the amount will be calculated based on Line Total Amount and the Distribution percent entered. If desired both can be entered.

Select ‘Ok’ to write the data to your worksheet. Select ‘Cancel’ to return to the worksheet without updating the sheet

Multiple REV distributions can be entered but only one REC distribution is allowed per transaction.

Distributions against a line must total 100% per class. For example, if there is only one Revenue distribution the API will assign this as 100% regardless if the entered % is different. If there are two Revenue distributions for a line and they do not total 100%, the API will return an error to adjust the data accordingly to equal 100%.

Note: The REC distribution is not required as the API will automatically derive the code from the instance's Auto Accounting configuration.

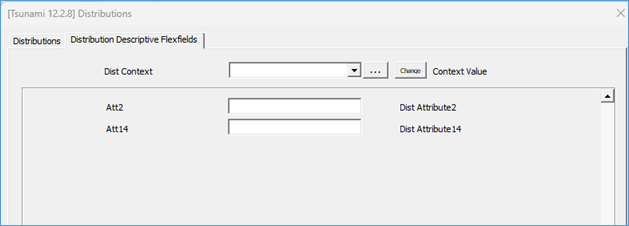

b) Distribution Descriptive Flexfields

Refer to section: