Tax

AP Invoice Wizard offers a number of methods for loading Tax Distributions.

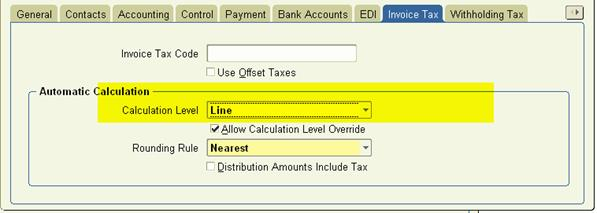

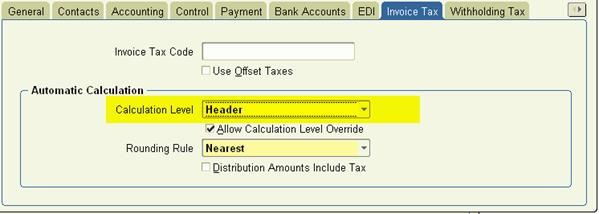

The choice of method is dependent on the setup of the Supplier Site.

Some of the settings shown in the form are irrelevant to AP Invoice Wizard. The ‘Allow Calculation Level Override’ setting is ignored, also the ‘Distribution Amounts Include Tax’ setting.

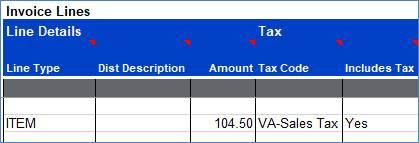

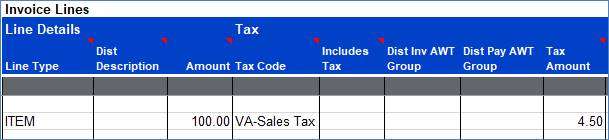

Calculation Level set to Tax Code or Line

In this case Oracle Payables WILL calculate Tax on Distribution Amounts loaded through the AP Invoice Wizard, provided a Tax Code has been selected.

Because of this, the ability to load separate Tax Distributions has been disabled.

You may choose to load amounts that Includes Tax, or Excludes Tax. Enter this in the ‘Includes Tax’ column on the spreadsheet. The checkbox on the bottom of the form above is for Invoices entered via the Oracle form only. The spreadsheet setting overrides this value.

OR

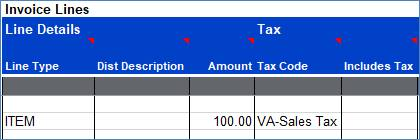

Calculation Level set to Header or None

In this case Oracle Payables WILL NOT calculate Tax on Distribution Amounts you load with AP Invoice Wizard, whether or not you have selected a Tax Code.

Because of this, the ‘Includes Tax’ column has been disabled.

You must load Tax Distributions explicitly. There are two options to achieve this:

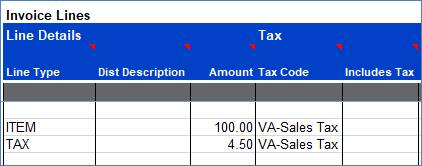

(a) Separate TAX Distributions on their own row on the spreadsheet.

(b) Include Tax on the same Row as the ITEM Distribution

Invoices with Multiple Tax Codes – Release 12

To load invoices with multiple tax codes you must enter your data in one of the following formats:

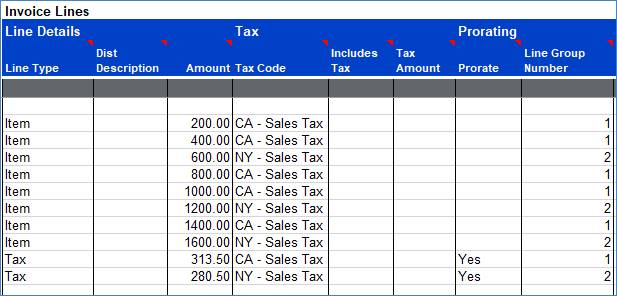

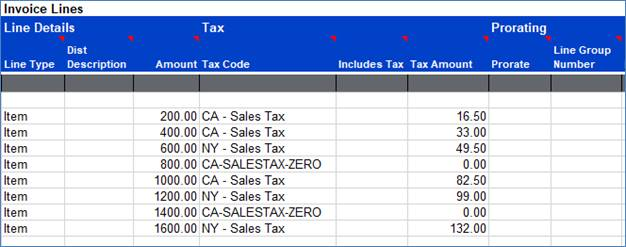

(a) Separate TAX Distributions on their own rows on the spreadsheet, manually entered Line Group Number values.

Oracle Payables uses a combination of the Prorate Flag and Line Group Number to determine which item lines have the associated tax component.

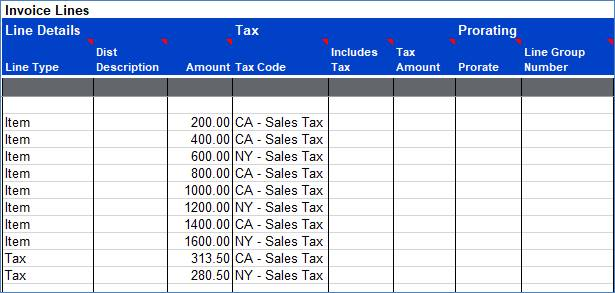

(b) Separate TAX Distributions on their own rows on the spreadsheet, no entered Line Group Number values.

If you omit the Line Group Number, as per the image above, the Wizard will automatically calculate the appropriate Line Group Number and populate the interface with this value, along with the Prorate Flag before the import into Oracle Payables is run.

(c) Include Tax on the same Row as the ITEM Distribution, no Line Group Number values.

The Wizard will automatically calculate the appropriate Line Group Number and populate the interface with this value, along with the Prorate Flag, before the import into Oracle Payables is run.

Any tax value entered in the Tax Amount field will override the value calculated by the E-Business Tax engine if the Header level ‘Calculate Tax During Import’ field is ‘No’.

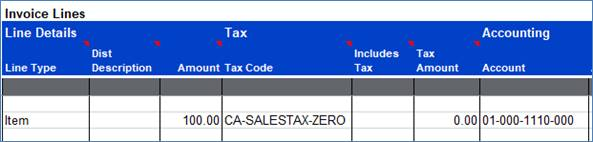

Overriding Supplier Defaulted Tax Rates with Zero Rated Tax Codes

To override Supplier defaulted tax rates on an invoice with a zero-rated Tax Code you can enter your data in one of the following formats:

(a) Separate Tax Distribution on their own row on the spreadsheet, manually enter Amount and select a zero-rated Tax Code.

(b) On the Item line enter 0.00 in the Tax Amount column and select a zero-rated Tax Code.

Refer to section: